Fed rate hike

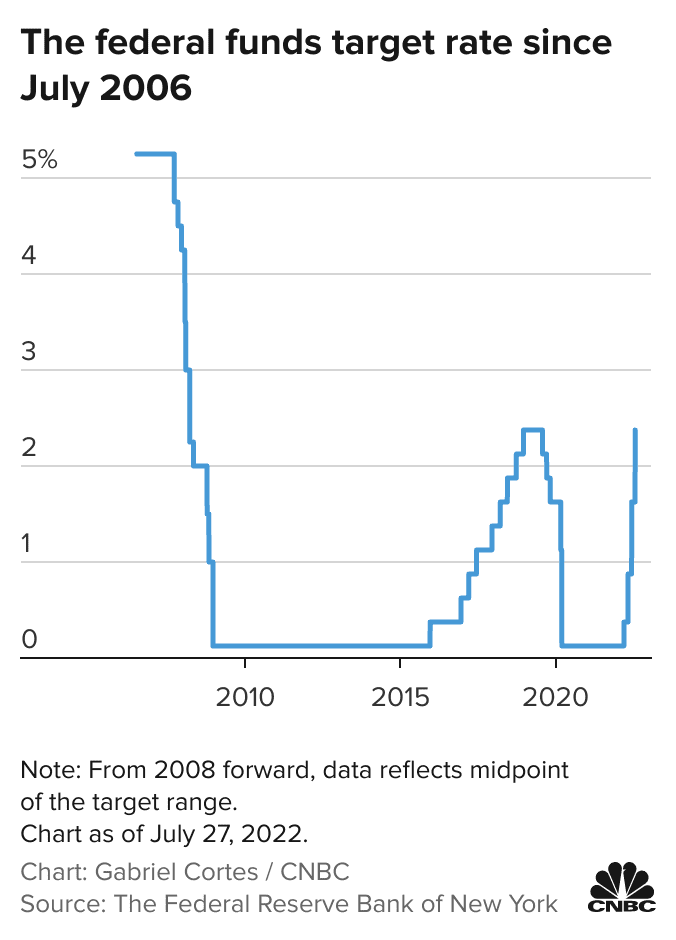

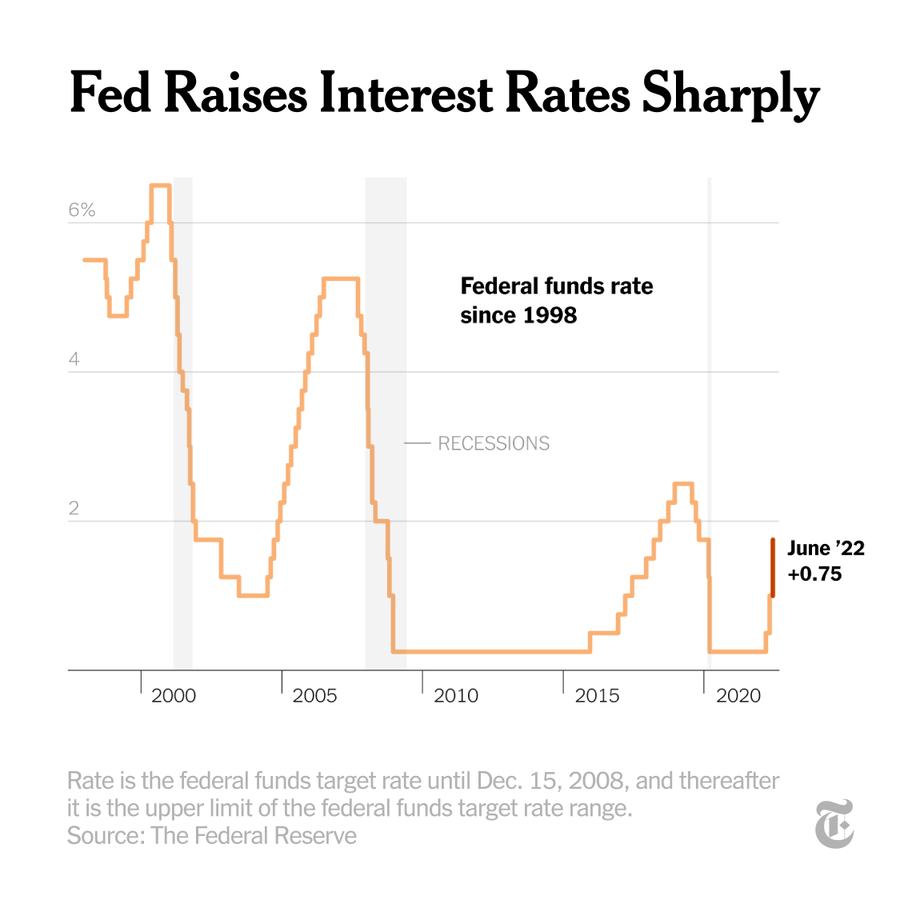

Adjustable-rate loans such as ARMs that are no. The rate hike brings the federal funds rate to a targeted range of 375 to 4 the highest level since January 2008.

Fed Cuts Us Interest Rates To Zero As Part Of Sweeping Crisis Measures Financial Times

The Federal Reserve announced it was raising its key rate by another 075 percentage points lifting the target range to between 3 and 325.

. At the Feds Sept. The Federal Reserve delivered its latest monetary policy announcement with the central bank hiking rates by 75 basis points or 075 percentage point. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

AP PhotoJacquelyn Martin File. That implies a quarter-point rate rise next year but. Fed hikes interest rates by 075 percentage point for second consecutive time to fight inflation Published Wed Jul 27 2022 200 PM EDT Updated Wed Jul 27 2022 346 PM.

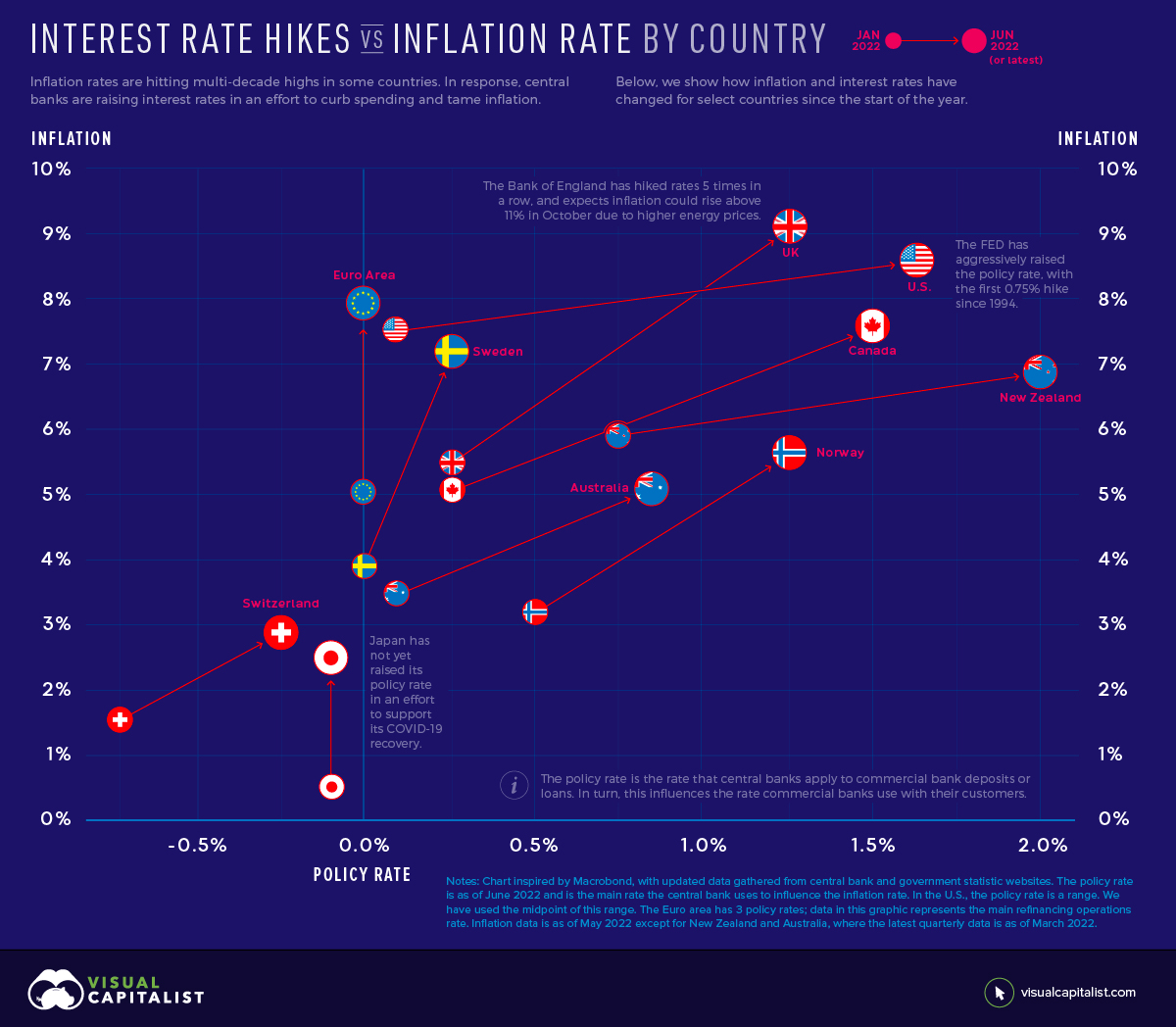

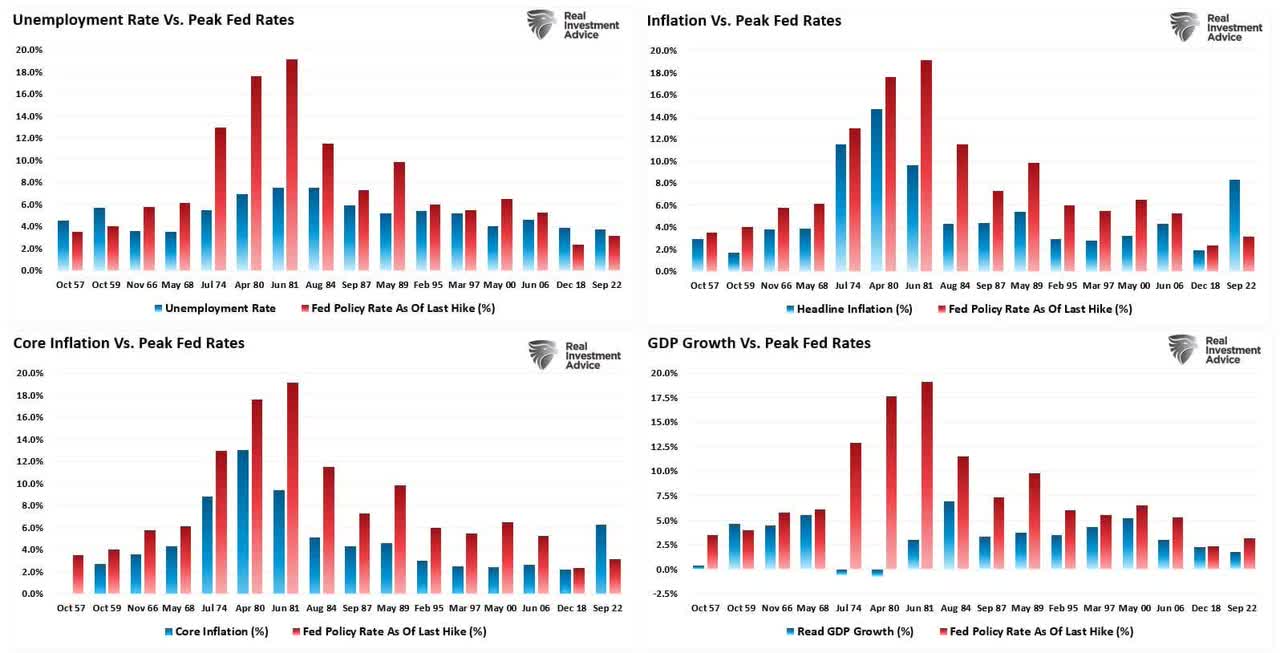

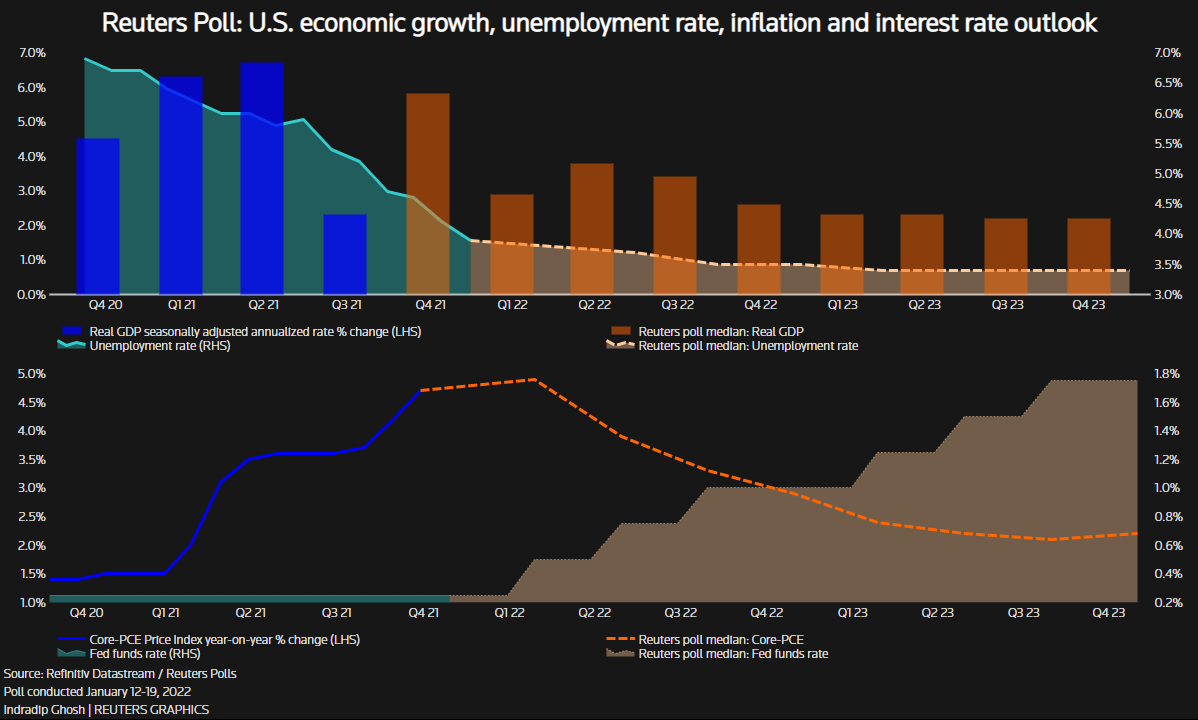

For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. Inflation projections also grew. Rate hikes are associated with the peak of the.

During his post-meeting conference Fed Chair Jerome Powell signaled. The latest increase moved the. Every 025 percentage-point increase in the Feds benchmark interest rate translates to an extra 25 a year in interest on 10000 in debt.

The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. What rate hikes cost you. Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov.

The Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. Core Personal Consumption Expenditures the Feds favored measure of rising prices is projected to hit 45 this year and 31 in 2023 the Feds. The interest rate on federal student loans taken out for the 2022-2023 academic year already rose to 499 up from 373 last year and 275 in 2020-2021.

The Fed said it anticipated further rate increases going. The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released. 20-21 meeting the median estimate among policymakers pegged the peak fed funds rate next year at between 450 and 475.

Rate futures markets now imply. The rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. Key Highlights A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

The Feds target policy rate is now at its highest level since 2008 - and new projections show it rising to the 425-450 range by the end of this year and ending 2023 at. The Federal Reserve announced it was raising its key rate by another 075 percentage points lifting the target range to between 3 and 325. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

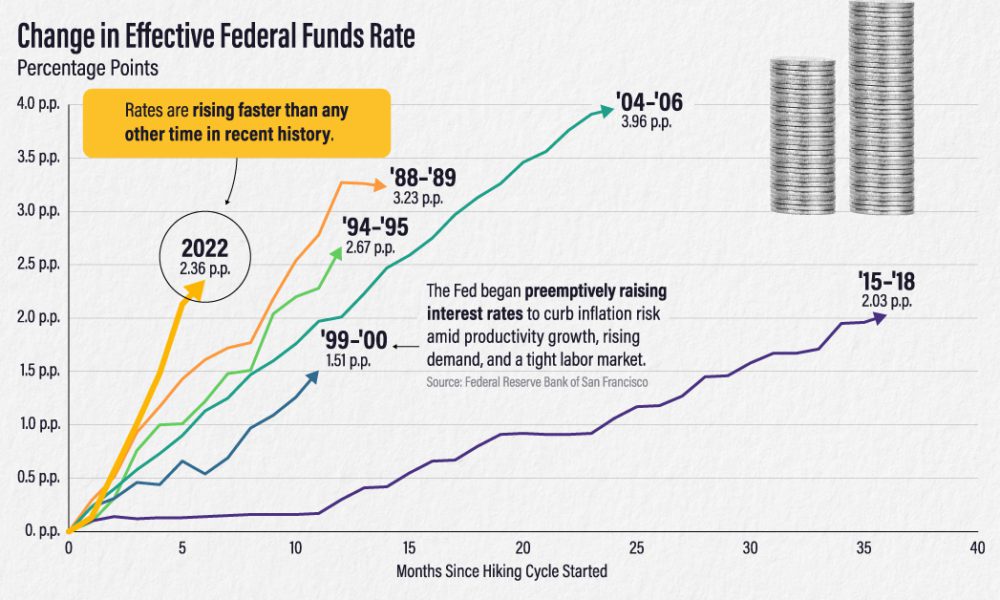

Powell announced another interest rate hike on Wednesday. So far the Feds five hikes in 2022 have increased rates by a. That means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt.

WASHINGTON AP The Federal Reserve pumped up its benchmark interest rate Wednesday by three-quarters of a point for a fourth straight time.

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

The Fed Delivers Biggest Rate Hike In Decades To Fight Inflation Npr

5 Things To Know About The Fed S Biggest Interest Rate Increase Since 1994 And How It Will Affect You

Fed Raises Interest Rate Half A Percentage Point Largest Increase Since 2000 The New York Times

Fed Rate Hikes Expectations And Reality Benzinga

Stocks Fell Right After Fed Raised Interest Rates Will This Continue

What Would A Fed Interest Rate Hike Mean For Markets Knowledge At Wharton

How The Stock Market Has Performed During Fed Rate Hike Cycles

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

Fed Rate Hikes Approaching The Breaking Point Seeking Alpha

The Latest Fed Rate Hike Is The Largest In 28 Years Here S The Silver Lining For Savers Nextadvisor With Time

Tight Rope History S Lessons About Rate Hike Cycles Charles Schwab

Why A Federal Reserve Interest Rate Hike Could Help To Lower Inflation As Usa

Fed Barrels Toward Another 75 Basis Point Rate Hike As High Inflation Persists Fox Business

The Fed Raises Interest Rates By 0 75 Percentage Points To Tackle Inflation The New York Times

Fed To Raise Rates Three Times This Year To Tame Unruly Inflation Reuters Poll Reuters